Why A Business Plan Is Important

The most important part of a start-up's life is the writing of a business plan. As explained in the last chapter, this is the responsibility of the founders - the technopreneur and the core team. It is the start-up's and founder's Bible. It is a step-by-step execution guide. It charts strategic directions. It provides insights into potential pitfalls. It tells the founders who their competitors are. Most importantly it tells them what the project's real value is and it is this future valuation that becomes a key start-up goal.

It is a book that has a story to tell. It begins with an introduction of what the value proposition is and why is it required, how the change will be implemented and whether the market needs such a change. It goes on to tell the founders how large the market is and how the start-up will be able to service those markets and what type of resources will be required. It concludes with an eventual goal. This may be an exit for investors and founders or on completing Plan A, they could move on to Plan B.

It is not something that is done only to impress investors. It is done to refine and clarify the technopreneur's vision. Investors read this plan because it provides them with insight to gauge the level of sincerity and seriousness that the technopreneur and his team have. If they have not taken the time to outline and plan their future, then to an investor they’re not serious about what they’re proposing.

Salient Points

Many investors will tell you that they have not seen many good business plans and that this is one of the reasons why many start-ups are unable to obtain any funding.

So take the trouble to draw up a good business plan. There is money available out there today and those with capital are looking for deals. Your start-up could be that investment. Attracting the attention of investors is pretty difficult. It takes a lot of networking and a lot of just plain old hard work preparing your business plan and yourself.

Investors, mainly venture capital companies (VCs) and angels, look at the credentials of the technopreneur and his team and they study the business plan. Angel investors are simply wealthy people who operate in a similar manner as VCs, but independently rather than with a firm. They are called “angels“ because they usually are not interested in controlling your company, but simply acting as mentors. VCs and angels prefer to see successful senior managers, successful businessman or entrepreneur is running the show. The calibre of the founders and completeness of the management team is of the utmost importance and the founders must be able to demonstrate a strong commitment and drive towards the overall project and team.

The second most important part of the business plan is the solution itself. Investors want to know the value proposition of the product or service, how innovative it is and how it delivers value to its users. Is the product a major break through and if so does it offer a new medium to service old needs? Or will customer education be required? Most importantly, they want to know who owns intellectual property that is being offered.

The third part comes up with a business model. It outlines issues like what the revenue drivers are, how workable the business strategy is and what the competitive advantage is. They will want to know how the business can craft a niche for itself during economic fallouts and yet at the same time has the ability to take advantage of booms. Lastly, the section concludes with sales and marketing strategies the start-up will deploy to meet its goals.

The fourth part of the business plan concentrates on the market.It outlines the market dynamics, such as growth prospects of the market (Is it growing, shrinking or maintaining?), the size of the market, its intensity, competition and revenue potential over the next 3 to 5 years.

The last part of the plan concludes with the financials, which should be in sync with the rest of the business plan. This includes the profit and loss, balance sheet and cash flow projections. A breakdown of financial into monthly projections for the first year and then yearly for the next 3 to 5 years is outlined. Other sets of financials should include return on investment calculations and cash flow projections at every stage of the start-up's tenure and its assumptions.

To perfect the plan and make it more appealing to investors, a business plan should contain a section outlining business risks and contingency plans. This is not necessary (it is a lot of work) but it will improve your chances of raising capital because it helps investors understand the risks that the founders face and what their backup plans are. It also prepares the team for any potential pitfalls.

Take note when tailoring your business plan for investors.Keep in mind the objective of showing them the plan is to justify the investment required and why the investors should part with his capital for this this project. A section, “Justification for Investment“ should be included.

Who To involve

All this may look like a lot of work, and it is. But if you are not serious about your own business, you should not bother. Each business plan is unique (if only we could go out to bookstore and buy that ideal plan for ourselves, things would be so much easier), because it is personal and a match of ideas, visions and goals of the founders in the future. Ideally, all founders should be involved and through this collaboration they can find out if they can work together.

A word caution. Founders should not attempt to write a business plan all by themselves. They should seek the help of an outsider who does not or might not share the same level of enthusiasm that the founders usually have.

It is this outsider's contribution that will greatly enhance the success of the business plan and its objectives, be it a fundraising exercise are an execution plan. It will be better if that ideas are bounced off with someone from the outside.

This outsider could be a consultantant, if you can afford one. Or you could seek advice of any businessman, another technopreneur or even your relatives. This outsider is someone who understands business, is experienced, and prepared to spend time with a technopreneur who is very excited about his vision.

While the outsider's contribution is on the market on the business side, yours is from the innovation end. This makes a perfect technopreneurial combination and such a person should be treasured and his contribution rewarded based on the company performance. All of us need mentors. Seek that mentor early, ideally at the business planning stage.

Writing The Plan

Before we begin, promise yourself and your partners that you will try, as much as possible, to be in unbiased, sincere and honest in your plans. Do not beef up the plan with sales talk or pitches specifically designed to excite investors. Concentrate on the problem, its value, the market and who else is doing the same thing and what the results are.

The objectives of the plan should be:

1. to obtain funding,

2. to provide a plan for early corporate development,

3. to guide an organisation towards meeting its objectives, and

4. to explain how the company's business will evolve.

The plan should:

1. be easy to read,

2. have a market-driven approach,

3. describe the competition,

4. explain the marketing/distribution plan,

5. highlight the company's uniqueness,

6. emphasise on the management's strengths,

7. and show attractive realistic productions.

Specimen business plan

1. COVER SHEET

The cover sheet (one page in) includes contact details, disclaimers and date of representation and to whom this document is made out. Clearly state the disclaimer, confidentiality and proprietary rights. Disallows the receiver to distribute such information without prior written permission from the company/author.

2. EXECUTIVE SUMMARY

It should include the following:

a. Introduction - states an elevator pitch for the project, the management team, the opportunity and objective of this plan.

b. Mission statement - states a larger plan of the team and vision, short and sweet within one paragraph.

c. Key considerations - states the resources, challenges and market dynamics required to make the mission stated above the success.

d. Objectives - states the objective of the business, i.e. creation of the new marketplace, new medium to service old needs or new products.

e. Expected accomplishments - states the achievements that this plan will make in three years, for example:

* Year 1: One million in revenue and completion of Product One.

* Year 2: Three million in revenues and software program Version 2.1 launched.

* Year 3: Seven million in revenues and officers since six countries.

f. Required capital - states the amount of capital required to complete product development and launch and in execution of this plan prior to being profitable. Clearly states the amount of money to be raised and how it will be spent.

Note: It is advisable to write the Executive Summary (ES) section after the entire plan has been completed. The ES section is the first section of the plan and its objective is to keep the reader interested; if it is too fantastic, it will be dumped without the rest of the document ever being read. If it is too soft, it will have the same effect.

The ES is sually no more than two pages and six paragraphs. It tells an investor or a potential partner what the rest of the plan entails and it is the only document that goes to the venture capital firm or banker first. If there is interest, they will ask for the rest of the plan. Never send out thr complete plan to anyone without them asking. It dilutes your value proposition and takes away any chance of being funded, because investors like to talk among themselves and they will say "Oh I have seen that deal before. If I were you I would pass it."

3. OPERATIONS

This section would include information on the:

a. Management team - states the names of the key managers in the business, their roles, responsibilities, and a short description of their experience, which should be in line with their present responsibilities. A summarised version of their CVs should be added and a complete one provided on request.

b. Compnay ownership - states the breakdown of shares held by each party within the organisation. Should clearly state who owns how many shares, type of shares, be they founder, preference or ordinary shares and names of investors if any should be added here.

c. Invetors - states background information about investors if any, whether they are silent partners or active founders and their roles within an organisation. Mention their level and reason for interest, financial, strategic partnership or any other type of arrangement. Lastly, state clearly any other value add the investors bring to the organisation besides capital.

d. Partners (if any) - state the partnerships that the business currently has and how they assist it in acheiving its goals.

e. Gaps (if any) in management or partners - states the potential gaps that the management has identified, be they on the management side of the business or partnerships that the business lacks. Define them here and stress their importance.

Note: The Operations section tells partners and investors that the project is of value and can be executed successfully due to the managment expertise available and they ready partnerships in place to make the overall vision a reality.

Investors are looking for information that tells them the managment team has qualities which makes them responsible and caring towards the needs of shareholders. They want technopreneurs who can fulfil the goals outlines in the plan with the objective of delivering the returns promised.

The operations section tells the reader the level of resources the company readily has which can make the project a success. Investors can ease the financial burden as welll as make the organisation grow faster by creating an alliance between two of thier portfolio companies or providing some other sort of value. Various start-ups are known to have exchanged equity for revenue deals, thus making a win-win proposition for both parties.

Similarly, partnerships are more important because it opens more doors to additional sales.

In the New Economy, business is conduted via various networking events, partnerships and various levels of alliances and affiliates. If an organisation has a ready partnership network in place, half the battle has already been won. A start-up could seek a partner who has an already established customer base and by selling the star-up's new innovation or solution, both parties would be in a win-win situation and additional revenue derived.

Lastly, identify any gaps in the operations of the business and clearly define them. This helps the investor to guage whether he can offer value in these areas besides providing capital and play a larger part to make the business a success.

4. BUSINESS MODELS

Different technopreneurial companies have different business models. The business model spells out how the company makes money. In the most basic sense, a business model is the method of doing business by which a company can sustain itself.

a. Purpose statement - states a brief summary of what the Business Model section contains. No more than one page, it should be intersting enough to draw the reader's attention to the rest of the sections.

b. Description of the business - describes the business, defines the industry and the opportunity in a clear and concise manner. In short, what the start-up does and the opportunity.

c. Value proposition - tells what the value of the start-up's product/service is; if it is required, and why and how innovative and benefical it is to users.

d. Product/service - describes the product/service in detail, how it fulfils the need as descrived in the business plan. Product/service comparison charts should be added with core focuson the solution's features.

e. Business model/Revenue model - defines the business model of the start-up (also referrred to as revenue model) and mentions how the start-up will generate income. If you have a unique revenue stream, be sure to describe it.

f. Competition/pricing analysis - states the direct, indirect and incidental competitors in the same space, defines competitors' business strategies, market share and concetration. Based on this information, an outline of the pricing strategy for start-up's products/services is drawn up.

g. Business development strategy - states the strategy to be used for the penetration of the products/services into the market. Includes the correct pricing, together with the appropriate market segmentation the start-up is targeting. Execution plan is stated here.

Note: The Business Model section provides information on how the start-up is going to generate income for its solutions and outlines the value proposition, type of solution, competition, pricing analysis and business development strategy.

More on Business/Revenue models

Advertising model: An extension of the traditional media broadcasting. The broadcaster provides content and services mixed with advertising messages in the form of banner ads.

Affiliate model: Provides purchase opportunities wherever people may be surfing. Offers financial incentives to affiliated partner sites.

ASP model: An Application Service Provider provides services and charges on a monthly basis instead of a yearly fee. An ASP provides hardware, software and support, all bundled and offered for a single variable monthly fee and facilitates customers with a cost effective solution with little or no upfront setup costs.

Brokerage model: Brokers are market makers who bring buyers and sellers together and facilitate transactions. A broker makes money by charging a fee for each transaction he/she enables. Merchant aggregators and many other aggregators fall into this category.

Infomediary model: An infomediary collects and sells information about users and their surfing and buying habits. An Infomediary may offer users free Internet access or free hardware in exchange for detailed information about the surfing and purchasing habits.

Licensing model: Provides solutions on a leasing basis and the solution offered, is never sold outright but only rights to use are licensed. If periodical updates or maintenance srvices are provided then yearly maintenance fees are also applied on top of the license fees.

Merchant model: Classic wholesalers and retailers of goods and services. Sales may be based on list prices or through an auction.

Manufacturer model: Predicated on the power of the Web to allow manufacturers to reach buyers directly, thereby compressing the distribution channels.

Subscription model: Most content providers and information exchanges fall into this category; they offer services for a fixed monthly fee.

In addition to the above, the market segment needs to be defined.

Business to Consumer (B2C) refers to companies which deal directly with consumers and are very close to the value chain. During the dot.com fallout companies in this sector were among the first to collapse.

Business to Business (B2B) refers to companies which deal specifically with businesses instead of consumers. This is preferred by many venture capitalists because businesses are known to be more reliable in dealings than consumers, and start-ups that structure their models to service businesses instead of consumers have a strong sustainable base to tap upon.

More on competition

With the industry, business revenue model, value proposition, products and services sections defined, competition has to be addressed and identified. Most founders falsely assume that they have no competition. Competition is direct, indirect and incidental. Direct competition refers to solutions that compete head to head with the start-up's offering. Indirect competion is solutions that are substitutes to the start-up's offering.

Incidental competition occurs when the start-up is trying to penertrate a market and there is already a major established player who has the required network of customers and resources to execute the start-up's model with little or no effort.

In such a case, the competition is incidental once the competitor identifies the start-up's offering and sees value in it for its own customers. With its core business facing outside price pressures and competition, the competitor may choose to diversify and enter a market to build new revenue streams and take away whatever edge the start-up has.

Addressing such competition and threats provides a strategic path to founders and investors on how to address competition and show the start-up's way forward.

Once competition is addressed, the next step is pricing the product correvtly and hence the need for a pricing analysis. Comparision charts should be added, comparing the solution's value with other similar products. If prices are too low and profitability questionable, then the investor would like to see the rationale behind such low pricings. They want to know whether low prices are part of the start-up's strategy to build market share first and adjust prices later. If prices are too high, then the question is, are they realistic and sustainable?

Pricing is the key in the formation of a business plan. It provides a basis upon which financial goals and targets can be met and since revenue projections are made on the basis of quantity x price, pricing has to justify cost of operations and margins have to be kept if the start-up intends to become profitable.

More on business development

With the targeted market segment and pricing outlined, how will the start-up get its products across? What is the start-up's strategy of going forward to build the business and hit those revenue goals?

Is the start-up going to use any traditional channels for advertising? Is it going to deploy a sales and marketing team to make cold calls? Or deploy a partnership programme? This has to be clearly thought about and defined. No longer is the "Build and they will come" strategy effective.

If the product is being sold via the Internet, what is the advertisement strategy, how important is branding to the start-up and what are the start-up's unique selling points (USP). If the product is being sold via offline measures, then what about the packaging? And is the solution going to be bundled with others to hit quantity goals as outlined in the financials section of the plan?

5. MARKET ANALYSIS

The market analysis section provides evidence to the claims made by founders. Readers of a business plan expect to find credibility behind the claims of performance, market expectations and demands made in the business plan which are to be backed up in this section.

a. Market summary - states a summary of the entire chapter.

b. Industry research - states an overview, a larger picture and analysis of the specific industry and its trends. Outlines whether the specific market is growing, sideways or tapering. Industry trends, issues and solutions are addressed. All information provided here should be pertaining to the start-up's business model.

c. Target market - states an overview and a macro picture of who the eventual customers of the start-up really are and what the trends, issues and solutions offered in this area are.

d. Expected growth - states an overview on market and industry growth and such data is usually obtained from industry pundits who conduct analysis and make recommendations of future directions. The size of the market, its intensity, competition and revenue potential over the next three to five years are outlined here.

Note: Readers of the Business Plan look for a growing market in the start-up's business model. They want to be able to define how great the opportunity really is. Many start-ups make unreliable statements like, "The market is really BIG." Investors and partners want to be able to define BIG and the assumptions underlying that calculation.

It is a given that the industry may change and the pundits may be wrong, but in an environment where herd instincts prevail, it is often the case that the mone is flowing into deals in a specific industry only. Crowds often find solidarity with each other and the investment community is like this.

The market analysis section also provides a justification of claims made by the start-up regarding the opportunity and such information is heavily relied upon by market analysts. To ensure it is not misinterpeted in any manner, always ensure research data is from a relaible source or from a source whose information is considered reputable and credible in your particular industry.

6. FINANCIALS

Having a business financial plan is critical whether you are seeking loans from financial institutions or going in search of venture capitalists. The important financial statements are as follows:

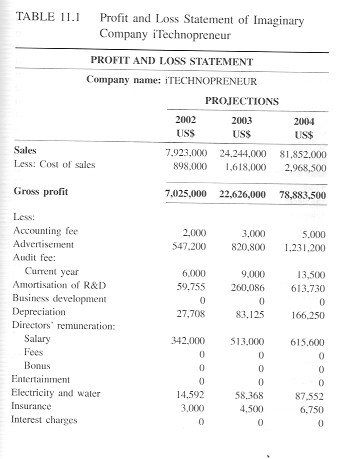

a. The Profit and Loss Statement is the most important document within the financials and it is the document where costs are balanced off with revenues and portrays an overall performance of the start-up's incomings and outgoings of finance (see table 11.1 for an example of a Profit and Loss Statement).

Note: For longer-term projects, the financials should outline a minimum of five to seven years of performance and forecasts. Short-term projects are usually ideal at three years, as shown in Table 11.1.

A month-by-month breakdown should be provided for Year 1, as readers would want to see the breakdown and progress of the first year and on what assumptions the calculations are based. This could also be in quarters if so required and could read Qtr1, Qtr2, Qtr3 and Qtr4 for the first year.

The Profit and Loss statement starts off with sales as the first column. Sales could be from anything that brings in revenue for the company. The second column is costs of sales, which is usually the purchasing of raw materials, payments such as commissions to sales agents or could be just about anything that makes the sale possible and whose costs increase with each sale.

The second half of the statement is for operational costs, which includes rentals, salary and other costs. Operational costs are deducted from gross sales and a total summary gives the year-end profit and loss balance of the company. If the company incurs a loss in Year 1 and Year 2, then the loss of the two years is what is ideally required to make the company function and be profitable in Year 3. If the company is profitable rigths away, then probably there is no need for capital from outside sources. But to allow the company to be able to hit its goals and profit milestones, it may need capital for cash flow purposes; therefore the second important dosument is the Cash Flow Statement.

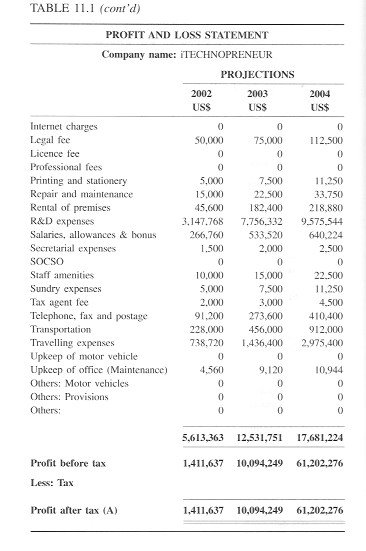

b. The Cash Flow Statement is the second most important financial document and outlines the cash flow situation during the course of the project. It outlines how much capital is available at any given time within the firm and whether it is enough to tide over operational issues. Table 11.2 is an example of a Cash Flow Statement of imaginary company iTechnopreneur.

Note: Cash flow is the lifeline of any organisation. If a company does not have enough cash to tide over its operational expenses the results can be disastrous. This statement is a document that outlines the financial health of the organisation.

The Cash Flow Statement shows all incomings of capital and net receipts. Capital may be injected into an organisation by various means, be it business transactional sales, or capital from shareholders, or borrowings. In the end it is of utmost importance to know how much cash the company has and it is this level of outstanding cash reserves that ensures the company is able to address any adversity which may occur. Most companies would ideally have two to four months' worth of operational cash in balance, for instance, companies like Microsoft would often maintain 12 months of cash flow in balance. Anything above that would be invested elsewhere.

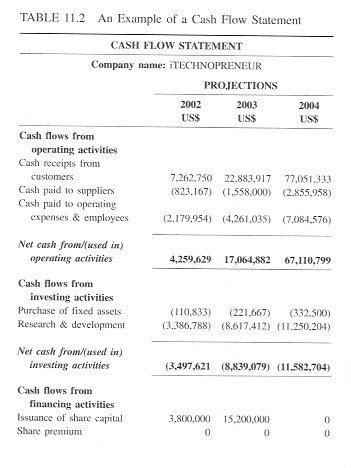

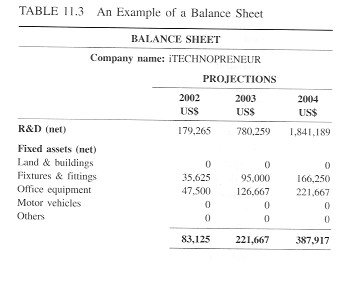

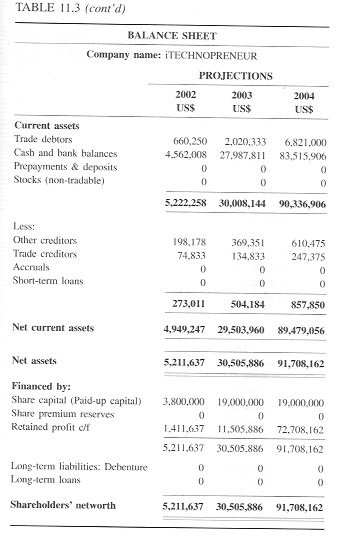

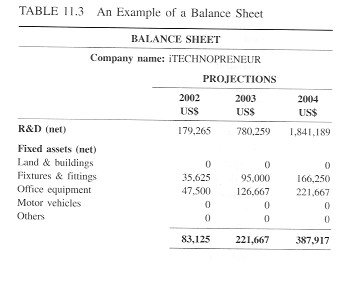

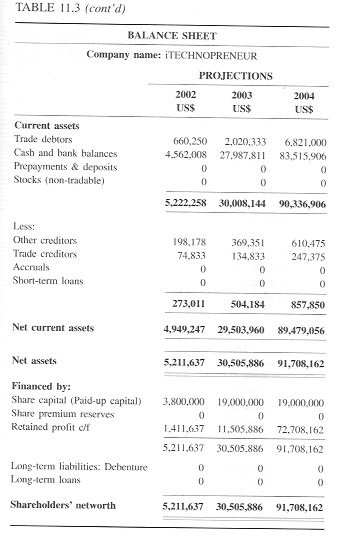

c. The Balance Sheet (see Table 11.3) states the overall assets and liabilities of an organisation. Assets could be in cash in bank accounts, receivables and intellectual capital. The Balance Sheet maps out the overall performance for shareholders and their worth at a particular point in time. Following is the balance sheet of imaginary company iTechnopreneur.

Note: The Balance Sheet balances out the totals within an organisation. (i) costs such as R&D cost are condidered assests but they may be assets that depreciate over time. Similarly, hardware and software that is purchased is an asset that is depreciated. Intellectual capital is an asset and various valiation models can be applied. With the total incomings within an organisation balancing off with payables such as short-term loans, trade creditors and collective accruals, the company is able to define its financial standing and performace. Technology-based companies usually have very few physical assets such as buildings and land, but they do have information technology and intellectual property assets. A model to value these has yet to be standardised.

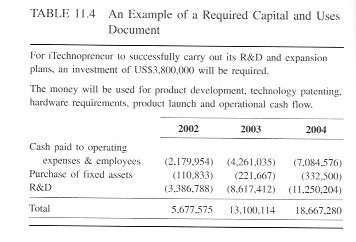

d. The Required Capital and Uses section outlines the level of capital required to make the project a success and the manner it will be deployed. For instance, imaginary company iTechnopreneur has a requirement as shown in Table 11.4.

Note: The start-up has to justify its capital needs and outline capital shortfalls, which usually occur prior to generation of revenues and being cash-flow positive. Investors particularly use this information to guage spending patterns of the start-up, the capital requirements and when this capital will be required so that they can come up with a timesheet for capital infusion. A timesheet basically maps out the tranches of the required capital outlay to the start-up as and when the need arises or when the start-up is able to hit its performance milestones.

e. The Return on Investment section shows the performance of an investment. ROI measures how effectively the investment generates profit; the higher the ROI, the better. Its calculation is based on the amount of earnings taken in divided by the amount of investment to generate the earnings.

For example, for an investment of $1 million, given the market valuation of $100 million in Year 5 at IPO, the return on investment would be a compounded annual return of 56 percent per annum.

To be able to define an appropriate level of ROI for investors, the start-up should set investors' hurdle rate.

A hurdle rate is the minimum ROI a company requires for investments. If the projected ROI on a proposed investment is greater than the hurdle rate, it is considered a desirable use of funds. If the projected ROI is less than the hurdle rate, the reverse is true. Most ROI measurments neglect this cost. The secret in doing this calculation is to work backwards starting with an IPO date. Once the IPO date is defined at Year 3 at $100 million, the second step is to work back to the seed round, pricing each successive round be fit into its appropriate ROI range. The end result will be a reasonable financing plan, complete with the number of shares for each party together with an appropriate level of ROI.

If this soundscomplicated to anyone without an accounting background, then accountants and third-party consultants should be hired for this purpose. Another caption would be to download a free Excel spreadsheet from iTechnopreneur.com for this purpose and look up the resources section for other complimentary stuffs.

f. Investors would want to know how the financial projections and assumptions made in a business plan were derived. The Financial Projections and Assumptions section basically fulfils this role and complements the market analysis section. It also outlines the basis of calculations used in the creation of the financials. Following are some examples of assumptions and financial projections.

Notes to the Accounts

1. The average collection period for all debtors and creditors is 30 days.

2. Revenue is recognised when invoices are raised.

3. The acquisition of fixed assets is apportioned on 30 percent for hardware, 40 percent for office equipment and 30 percent for furniture and fittings.

4. The estimated useful like of all fixed assets is four years.

5. Research and development cost are amortised over a period of four years.

Financial Projections

1. The company will target one customer every quarter at a pricing of $300,000 each.

2.Each salesman hired will contribute $50,000 worth of business per month.

3. Advertisment cost to provide ROI of $3 for each dollar spent

4. Market growth outlined is 30 percent per annum based on research from XYZ Co.

5. The company shall target 2 percent of the target markets.

Note: The assumptions section basically gives the bases of the calculations used in the formation of the financials because investors want to know whether the figures of profitability and projections made are achievable and can be sustained. This bring us to the closure of the financials section and to the last section of the Business Plan aptly named Conclusions here.

7. CONCLUSION

This is just the last section of the Business Plan.

a. Justification - states why the investor should invest in this project, what value is created by execution of this project, the investment returns created and its justification as a sustainable business.

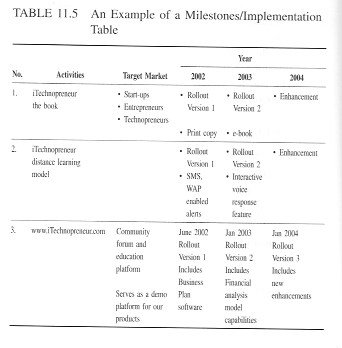

b. Milestones/Implementation Table - outlines the development plans of the organisation, when the start date is and when it (be it product, service or expansion) will be completed. The Implementation Table is part of the business development strategy and outlines target dates to meet its goals (see Table 11.5 for an example of a Milestones/Implementation Table)

Note: The Milestones/ Implementation Table contains information and deadlines which are important to the evolution of the company. It highlights to investors important product extensions, espansion plans and goals.

c. Risks/Contingency Plan - highlights any potential risks that the company faves, for example not being able to raise seed capital is a risk as if future rounds of investment are not forthcoming. This section basically informs the investors/partners of such risks and addresses them.

Note: In a technopreneur setup, the risk on new technology is always inherent in the business. Technology could make the start-up's businesses obsolete, or the services it offers no longer valid. In this section, founders should outline any potential risks that could emerge and damage the project's potential and if that happens, state what they will do to correct and address such a situation.

With this, we have completed the Writing the Business Plan chapter. Most people say that a business plan takes almost six months to complete. The real truth is that a business plan can never be completed because we live in a dynamic environment and it is subject to evolution, which happens every single day.

Also, ideally, a business plan should be fine-tuned each time it is presented to a select group for review. While the core of the plan remains intact, sections such as exits for investors should be added if the presentation is for that purpose. Similarly if the business plan is for an application for government grants whose objective is to build intellectual capital then a selection called Intellectual Capital should be added on such an issue.

Most business plans are about accessing capital and this brings us to our next chapter, Raising Capital.

Chapter 11 Writing The Business Plan >>>

Technopreneurship Development - A Role for Society in Technopreneurship Development, a chapter written in 2002, explains the creative destructive forces at work in practically every aspect of human life and the reasoning for the massive confusion, leading up to revolutions, lack of employment opportunities and governments fiscal deficits. Technology is usually blamed for making the world a smaller place, the writing was on the wall since the late nineties, this chapter refreshes our memories.

Technopreneurship - The Successful Entrepreneur in the New Economy - Daniel Mankani. Published 2003. Pearson Education Asia - All rights, copyright reserved Daniel Mankani { ISBN0-13-046545-3 }