The Market Is Not A Casino! - Daniel Mankani

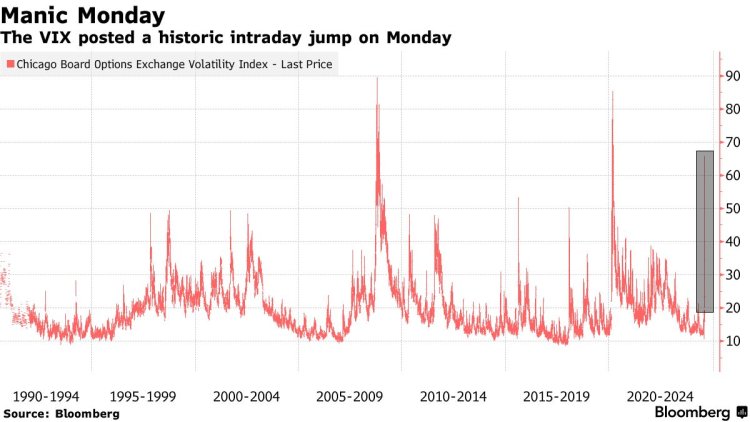

Mayhem Monday! The 5th of August 2024 is going to go down as one for the history books for world stock markets. A black Monday of sorts and a very large down day in the American Stock Markets which witnessed the volatility index trading at a extreme high of 65.73 and a beacon of what's to come. It's a Racket! The Market Is Not A Casino - Its a Racket!

Mayhem Monday! The 5th of August 2024 is going to go down as one for the history books for world stock markets. A black Monday of sorts transpired out a very large down day in the American Stock Markets which witnessed the volatility index trading at a extreme high of extreme high of 65.73.

You may ask why is this important! - Anyone who has a long trading history and understands the concept of slippage will know when the VIX index trades as high as it did on the 5th August 2024 should also know when the market is in this zone it can't be traded. It doesn't even really matter which side you are on Buy Or Sell. Mr Market screws both sides with slippage due to expansion of risk premiums and execution becomes extremely difficult.

The index which traded in the following manner in its past 3 days was making significant deviation from its normal distribution and its average, these are 3 sigma moves and every student of quantifitve finance or risk asset manager ought to understand what these price deviations means.

| Date | Open | High |

|---|---|---|

| Aug 5, 2024 | 23.39 | 65.73 |

| Aug 2, 2024 | 20.52 | 29.66 |

| Aug 1, 2024 | 16.20 | 19.48 |

| Jul 31, 2024 | 16.66 | 16.77 |

if not they are all going to lose money for their clients, however many asset managers and retail traders went shopping for discounts on this day and despite the subsequent market bounce they are still under water. They are going to lose their money. Here is why!

This is a very significant market event where risk cannot be priced, spreads widen to levels where even net asset values cannot be calculated properly and brokers in order to protect their books go chop, chop, chop as everyone seems to be underwater but may be not. On the other side of the spectrum due to these widening spread price discovery suffers, getting into a trade and getting out carries significant risk due to these elephant leg spreads in between bid ask prices.

Quantititve Finance Students and Asset Managers key role of Investing is Risk Management and many Fund Managers Of The Day Have Hardly Any Experience or do not understand the consequences of getting into a trade where instantly you are at a loss of a significant degree, its a day in which risk cannot be priced at all or measured efficiently and whoever trades is going to lose money either to the dark pools or to traders who will only accept the trades with significant risk premiums due to this extreme high volatility.

They say "Its Only When The Tide Goes Out We Can See Who Is Swimming Naked" and it was this day, everyone witnessed those who went long and bragged about it exposing themselves.

The Market Doesn't Turn Till The Greatest Fool Of All Has Gone Long!

It was very strange to me when Cathie Woods of Ark Investment released the following video over this past weekend. When I looked up her track record in a year where the markets have practically doubled her fund is actually down by 20%.

Sounding concerned probably knows more bear market blood letting lies right ahead.

Rising tides lifts all boats and in a market where the federal reserve has created an entire generation of traders who have approached the markets with their Casino type attitude buying every dip FOMO style making the Stock Market the greatest casino in the world and fund money managers basically fulfilling a market demand for this demand vide various products of sorts, such as ETF's and making it easy for gamblers to participate in the merry go round of sorts, ETF's by itself are tools which have a negative gearing for investors who invest in them thinking they are like a mutual fund, they are not they are destructive to investors portfolios.

The Daily rebalancing of ETFs in the end creates negative return for participants and as far as stocks are concerned they are also fundamentally manipulated by creative accounting and look ahead statements, the stock market is no more reflective in its original form, companies do not pay dividends, there are no growth stocks and there are no companies making significant innovation. Lots of Hopium.

Now you may ask so where are we now. The climax of greed was witnessed on Monday 5th of August 2024 and whoever bought is underwater on this day and now everyone is in the hope stage.

Will they Federal Reserve once again release the plunge protection team as it did in 2017 when the market didn't make any 2% down moves for over a year and Vix hit historical lows. We shall see!.

The market is not a casino! It is a Racket of sorts and this is the proof.

See the stages of market.

Greed. Hope. Fear for the period 1997-2000.

This time its no different.

What's Your Reaction?