Technopreneurship - The Opportunity

If there is anything that we have learned from history so far it is that investors psychology is part of the cycle. This occurs in phases - greed, hope and fear. The cycle starts with greed, with the hope as a consolidation phase and fear as the final shakeout. It begins with greed again.

Likewise economic cycles are simple - boom and bust. It is during the boom that one should look to take profits. Starting, acquiring or building a business should ideally occur during the bust phase, when prices are low and the cost of skills, processes, rents, businesses and services are more than fairly priced due to the competitive nature of the marketplace. Unfortunately we usually do it the other way around. We often get too bullish when the economy is growing and extremely bearish on the economic downturns.

It is the opportunities in an economic downturn that even the bigger established companies are neglecting. They are too focused on survival, correcting the facts effects of 'irrational exuberance” that had built up in their businesses and the overall economy during the greed or boom phase.

There in lies and opportunity for technopreneurs.

Start-ups and businesses that take advantage of opportunities during the bust phase often have a better chance to survive and prosper. Their business foundations are solid. They are also driven by fear. This makes them adaptable to change and evolution. Finally they do not carry the excess baggage of the previous boom, be it psychological, financial or operational.

Today, what matters is that a rsolution is cost-effective, reliable and delivers value. If a technopreneurs can deliver value to them and fulfill their demands, customers will trust and use him.

So what are the opportunities for technopreneurs? These lie in solving, through the use of technology and outsourcing, and creating new value chains and customer satisfaction, the problems facing established businesses.

Since paradoxically the Internet is both the cause and the solution of these problems, we will first look at the impact of the Internet on businesses, using two industries, telecommunications and banking, as examples.

The Internet

It is the Internet that has contributed to many structural changes in business dynamics. As a result of cheap communications and globalisation, many of these structural changes are damaging the established structures of major established industries and companies.

With the advent of the Internet and other technological advancements, many established incumbents are finding that their products and services are no longer required. Many are unable to figure out why this has happened.

The effects of the Internet have also brought about a new set of competitors who are both small and big simultaneously. They can service customers everywhere from anywhere. These small technopreneurial firms from across the globe and from all walks of life are taking up the challenge of creating value by thinking of new processes, ideas and solutions for processes that have now become redundant.

For example, such are the changes and evolution of the Internet that with the introduction of the e-mail, our reliance on cable, telex and even the telephone has diminished. When was the last time you sent a fax or telex?

With total connectivity, some even predict landline telephone may one day become obsolete. Likewise the manner we use telephone numbers for identification could be replaced by our Internet handles - e-mail addresses and domains.

While the original telephony services were offered by huge telecommunication companies, today, similar services are offered by technology-savvy young technopreneurs, who ensure that e-mail works properly, or that the required bandwidth, service and security for those servers do not fail. It is these technopreneurs who have taken over the role of the telecommunications company that once employed thousands to deliver similar services,. While a technopreneur's business may be small in the amount of resources it uses and can command, the technopreneur's potential is huge. He can service anywhere, anytime, using less than 10 percent of the allocated resources for the same process as a telecommunications giant. This process is also more efficient and delivers real value to the consumer in areas such as cost, speed, quality and reliability.

Such changes are also occurring in many other industries, for instance, in banking. Once each bank had an entire department marketing credit cards to consumers and merchants. The department was involved with advertising, promotions campaigns, loyalty rewards, merchant acquisitions and customer services. This department probably had a yearly budget of a few million dollars and 25 to 50 employees. Today the cost of marketing credit cards is a fraction of those costs.

Banks either are outsourcing the entire process to a willing technopreneur who fulfills their target requirements at a lower cost or banks are trying innovative approaches such as an Internet website whose main focus would be to market credit cards.

The result is definitely more efficient and creative but in most cases the banks would have to accept that they have to share the pie with others. The banks also have to comprehend that proprietary information or technology is no longer an advantage and that data sharing is no longer a disadvantage.

Problems Of Established Companies

Companies today focus on cost savings, cutting those excesses and inventories that they had built up during the expansion phase. The goal is to report better financial numbers to their shareholders as pressure continues to rise on management to do better.

But most companies have yet to restructure or understand the effects of the new economy businesses and their dynamics. The Internet has made comparison easy, creating a more competitive environment for businesses. They have yet to stop using obsolete business strategies and processes that, unfortunately, are you still taught in business schools.

These companies are hostile to and disbelieving of technology. Many of them invested heavily in technology only in the final days of the Internet boom. As a consequence, they did not see the benefits. Instead they incurred huge losses as consumers cut spending after the wealth effect disappeared and the global depression got underway.

The distrust of technology means they are failing to pay attention to the larger picture and they are slowly and surely making themselves obsolete. Their cost-saving strategies are cutting down their own competitive advantages, which they had originally built up.

They have retrenched people and are continuing to do so. They are closing capital-intensive departments and they are liquidating subsidiaries that are not profitable. But often they fail to realize that these were part of a good long-term business strategy. So if the subsidiaries were involved in research and development; some departments for servicing customers and some new businesses were part of the diversification strategy.

Granted that as the strategy had not taken into account the downturn in the economy, it should be modified, but not abandon.

There are only four ways of going forward for large corporations in then you economy - deploying technology that can deliver the processes efficiently; shifting the responsibilities elsewhere by outsourcing; creating new value chains; and focusing on customer satisfaction. We will examine each in turn.

Deploying Technology

Technology has been able to keep operational and business cost low, and as innovation and competition intensify, more technology is needed.

Intelligent business software applications are much in demand. They are called various names such as Enterprise Resource Planning Software, Customer Relations Management and E-Business Applications (see Chapter 6: De-mystifying Technology). The crux of the matter is whoever can think of a process or a mechanism to solve some of the issues bothering corporation today as a product to sell to them.

Similarly, if a consumer's lifestyle or process can be bettered with some simple application and technopreneur has a ready solution to offer, he could tape this opportunity and create a particular niche or market in this particular space.

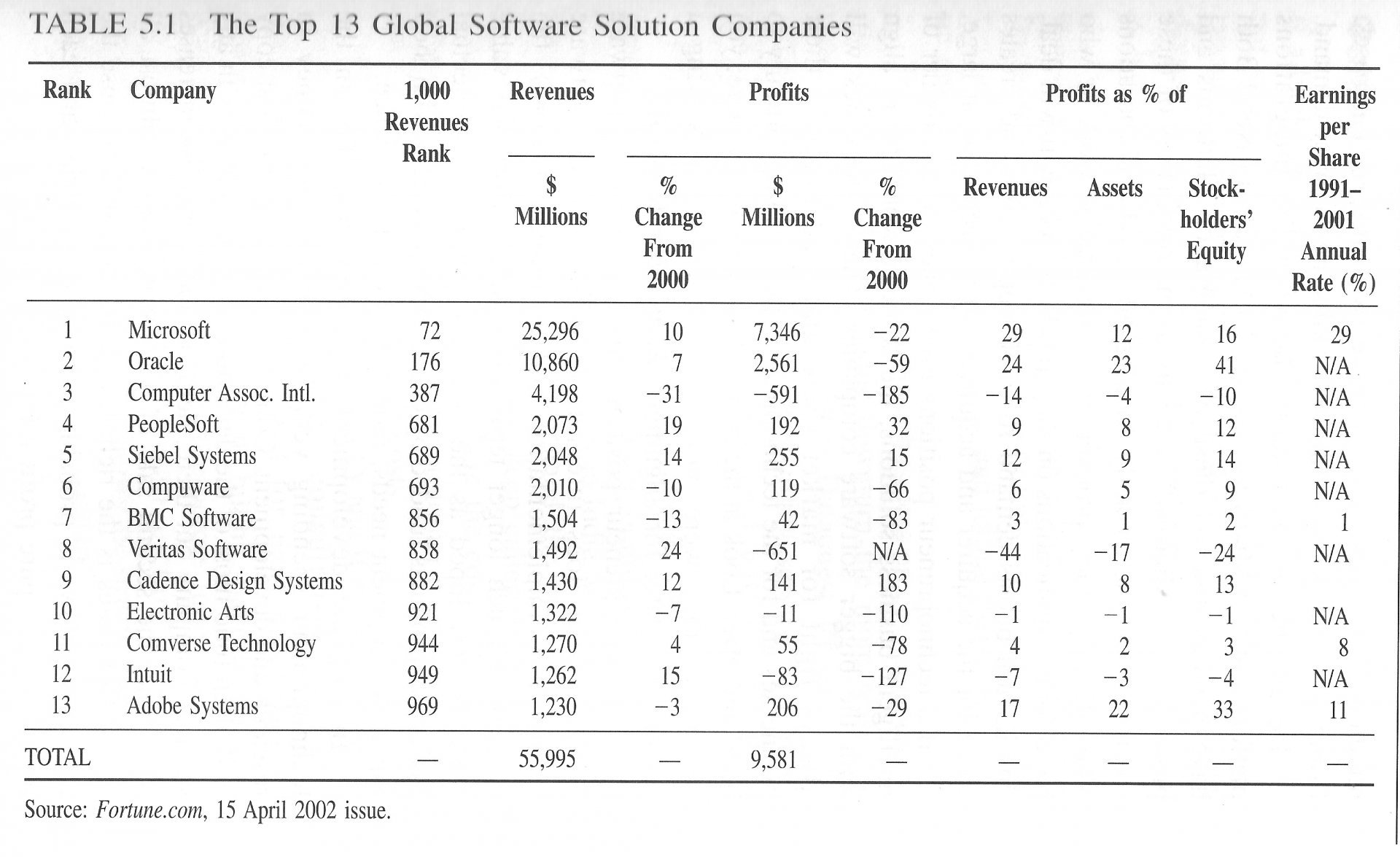

The top 13 globals software solution companies have recognized this fact and it is evident in their solutions that they have indeed created a niche and emerged market leaders in their own creative industries (see Table 5.1).

Each of these companies has created a brand that is associated with its products. Microsoft is well known for its desktop and service solutions, Oracle for its databases, Computer Associates as solutions providers and Siebel for their customer relationship management software systems. Such is the opportunity that innovation has brought. These companies are servicing new business models and needs.

Wannabe technopreneurs should use the recession, when most businesses are focusing on cutting costs and managers are feeling depressed, as an opportunity to look around and identify such opportunities in a particular industry or market. It is the identification of these market gaps and fulfillment of these requirements that have presented a huge opportunity for technopreneurs.

With the bursting of the stockmarket bubble, corporations today can no longer look towards the public markets for easy capital. This in turn has intensified mergers and acquisitions among larger conglomerates. Operations are merged and business processes shared in order to lower business operational costs, or cross-sell into new markets to create new revenue streams. The focus is on shareholder demands and enhanced corporate returns on investment dollars.

This has created opportunities for technopreneurs, as a merger of two corporations requires integration. As simple as this may all seem, it requires computer languages and middleware to seamlessly integrate two different databases. Companies and people with these skills are in great demand.

Recall the ongoing battle between the integrations platforms of Sun Microsystems (J2EE) Microsoft (.Net)? Both have bet big time on these new integration platforms and products; they, Microsoft and Sun, as the originators of these solutions, are increasingly looking to acquire corporations who either use their products to do integration work or who built the best applications on their products. As a win-win deal, this in turn boosts demand for their applications and creates value for the acquirer and acquiree and economy at large.

If a techno printer positions his business as a provider of intelligent business solutions, the strategy would be to align with the bigger software companies. These companies will always fight for market share and leadership in their businesses and for the technopreneur, this is an opportunity to build an offer. Look at the rich technopreneur out there; you will notice they were building with the aim of solving a problem and later for a realignment. Remember Hotmail!

If a technopreneur positions his business as a software company that does integration work (such a software consultancy, implementation and development work), the strategy is much longer term. Over time, substantial value could be developed as a company builds up intellectual assets and products funded by clients who provided with their initial development needs, requirements and experience.

In software development, the opportunity lies in the technopreneur spending very little of his own money in research and development. Companies who need the first copy will often fund most of the development phase and as with any services company out there, demand and reputation increases over time, the second sale of a software copy is almost all profit. Bill Gates is the richest man in the world because the cost ofWindows is probably a dollar or so today and each piece sold is a pure profit a hundredfold.

Outsourcing

If the bank can outsource the credit card department, then why not send the customer services department offshore where labor is cheap and skilled? If the downturn keeps on getting deeper the bank may concentrate on its core activity, which is to lend money and collect interest.

A decade or so ago, companies would never even envisage that they would be outsourcing their processes. They were responsible for their entire operations and supply chain. Evolution is changing this course and telling them, change or be phased out.

This process is referred to as business process outsourcing and the greater the economic downturn the more reason to outsource. According to Gardner Dataquest Research, the market for business process outsourcing services will reach US$128 billion this year. This total will rise to about US$234 billion in 2005.

Today, companies in India are already running customer services departments for major US corporations. A support call from Texas is routed to a company in India, which has trained staff to sound American, understand the product, provide technical support and, generally, keep callers happy. As the call center is located offshore where the costs of labour and operations are cheaper than in the customer market, this helps the US corporations lower their costs.

Outsourcing is picking up rapidly and if it can be done for customer services, planning, consultation, software development, it could also do it for most other backend processes such as administration, billing, payroll, training, logistics-management and human-resources functions.

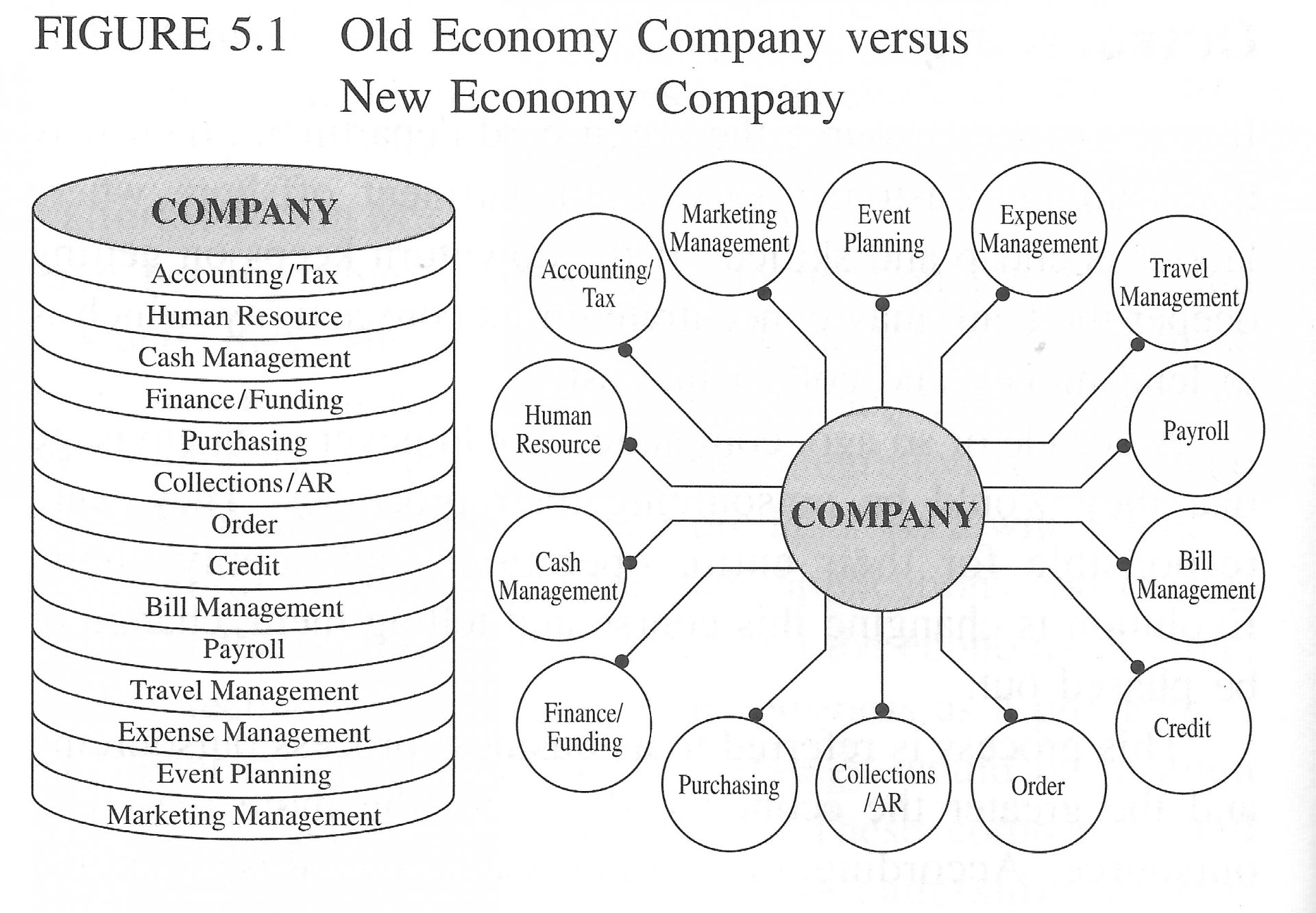

This has changed the overall picture of how an organization operates. Figure 5.1 shows the structure of an Old eEconomy company and the New Economy model.

As an old economy company evolve, it accumulated many now redundant processes (which were once necessary), which have to be done with.

As an old economy company evolve, it accumulated many now redundant processes (which were once necessary), which have to be done with.

These new requirements have created many new opportunities for technopreneurs since they are willing to think of new processes, solutions and products to solve these issues. Their input is intellectual and the profit from delivering value, which is not only efficient, but also strategic and synergistic to both the operations of the company and their customers.

Supply Chain Changes

In all markets and processes today, the cost of the middleman is often not sustainable as consumers are unwilling to pay that additional premium and a multiple level middleman scenario in supply chain cycles is being eradicated and replaced by more efficient processes that use technology. Direct connectivity and aggregators known as business-to-business exchanges are increasingly taking up these roles with ease.

Technopreneurs are creatively destroying the older value chains in order to offer a better version. These new chains not only cost less and are more efficient but also in some cases are total solutions providers.

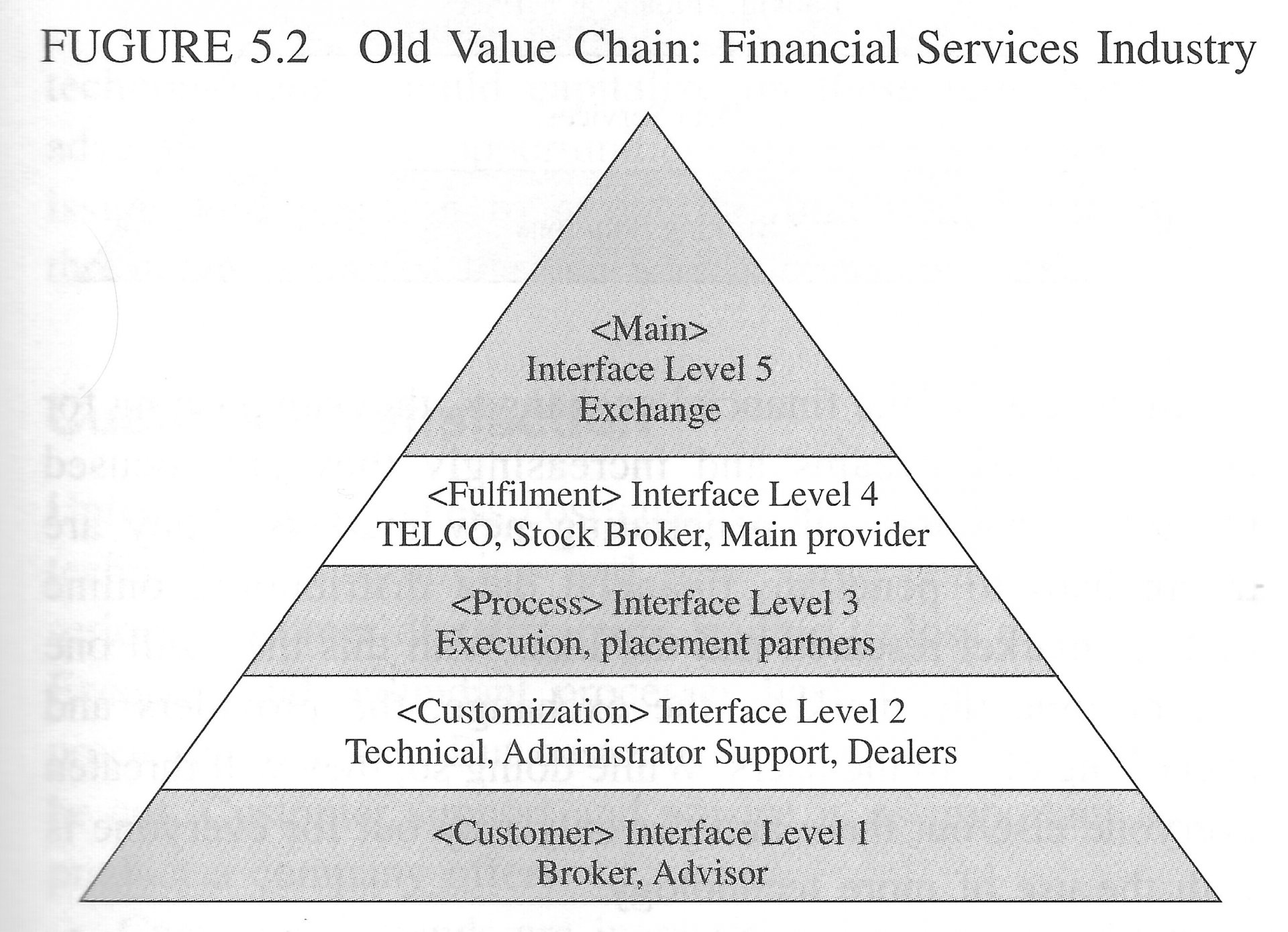

Let us look at the financial services industry where direct connectivity to the exchanges is making brokers obsolete (see Figure 5.2).

In the old value chain, there were many layers of processes and partners involved to get the same job done. Due to the advances in technology many of the processes have become either obsolete or are less in demand.

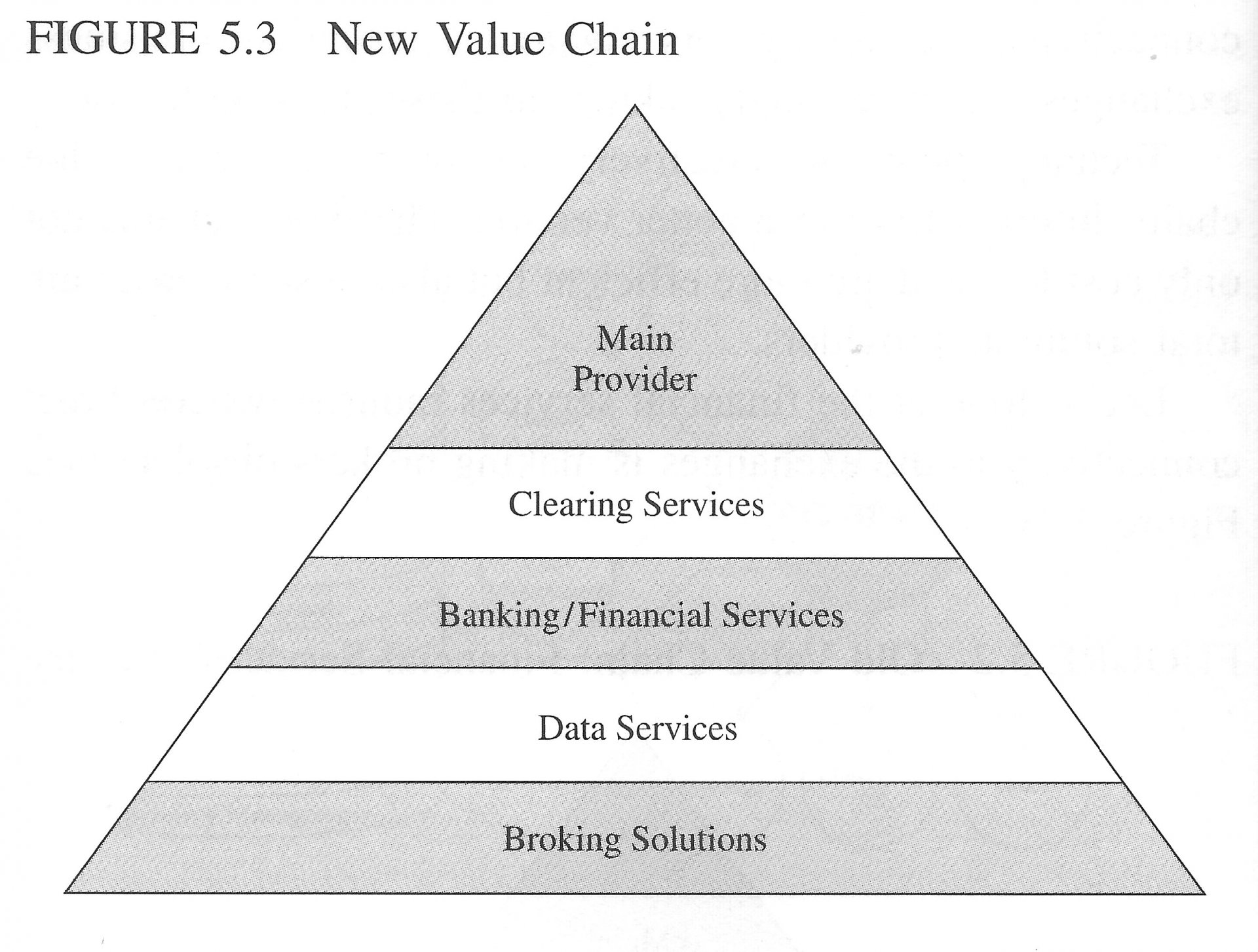

In the new value model (see Figure 5.3), companies are competing hard to reach on top of this chain and once there, they will be able to offer much more than before, to the very same customers.

In the case of the financial exchanges, they are pushing for new revenue streams and increasingly they are focused towards servicing and penetrating new markets. They are trying hard to penetrate financial data distribution, online trading, market research and the like. With this they will one day become the markets, the exchange, the providers and everything else to the users. While doing so, they will threaten everyone else out there and the only way out for everyone is with the use of more technology.

It is the usual grow big and fast strategy, but the only difference this time around is that it is value driven. Create value by offering total services, solutions and applications and generate revenues from these new offerings.

First it was brokers' salespersons that had to go with the advent of online trading, now increasingly the financial exchanges are gearing up to be able to service customers directly, so someday you will not need Datek or Charles Schwab to handle your accounts.

Datek and Charles Schwab probably realize this and are now turning to become exchanges themselves so they could compete with the exchanges head on. The exchanges, on the other hand, would require solutions that replicate the rules of Datek and Charles Schwab so they could manage and offer a direct trading to consumers.

Similarly once the brokers is obsolete how will the exchange manage all the processes or roles the broker carried out previously? This can be done with the deployment of technology.

Intelligent business solutions are the way to go forward, technopreneurs should capitalize on these issues and take advantage of these opportunities. Start by envisioning these issues and position to assist the one who is doing the threatening or assist the one who is being threatened.

Customer Satisfaction

Unfortunately mindless cost cutting, and inappropriate use of technology, outsourcing and new value chains can cause serious customer satisfaction leading to loss of customers. Excesses and redundant processes have to be cut a new processes tried out. But customer support and service cannot be cut. Customer support and services is as important as any product a company offers.

Customer demands are increasing even as companies cut cost. While not prepared to pay more, the growth of technology, particularly the Internet means they want to have instantaneous responses to their demands. Many corporations are not meeting these demands because costs remain their priority.

With costs becoming the major driving force, structural changes to the value chains corporations and industries had to be made. Cost intensive processes, such as the middleman and intermediaries were dropped without thinking through the implications. Corporations are see servicing consumers directly, and the benefits of using middlemen are being replaced by giving customers better prices and lower costs.

This often does not work. Customer service levels are deteriorating even further and customers are leaving.

Without intermediaries, customer acquisition is more difficult. It was the middlemen who had the strongest incentive to acquire more customers. Now that they have been discarded in favor of direct selling, and the added-value is now missed.

Today offering value to consumers in terms of price, product, or service is one of the largest opportunities brought about by this evolution and there are only a few who can envision this. There is so much choice and data out there, yet consumers are unhappy as their demands increase and their local suppliers are unable to fulfill them. For instance do you like your local newspaper? Is it what you want? Do you find it biased at times?

If so, as a consumer what do you do? Once you didn’t have a choice. But today, you can turn to the Internet, looking for another source you feel comfortable with. It’s the same with any product or service.

Such are the challenges that have made customers the most important asset in any company. Once the customers are gone, the company goes out of business. The size of the corporation or its reputation is no longer important. It is customers, stupid.

The key in retaining or acquiring customers is to provide them value for money service. Solving the problem of identification of value and creating it is the basis of the next chapter.

Chapter 5 The Opportunity >>>

Technopreneurship Development - A Role for Society in Technopreneurship Development, a chapter written in 2002, explains the creative destructive forces at work in practically every aspect of human life and the reasoning for the massive confusion, leading up to revolutions, lack of employment opportunities and governments fiscal deficits. Technology is usually blamed for making the world a smaller place, the writing was on the wall since the late nineties, this chapter refreshes our memories.

Technopreneurship - The Successful Entrepreneur in the New Economy - Daniel Mankani. Published 2003. Pearson Education Asia - All rights, copyright reserved Daniel Mankani { ISBN0-13-046545-3 }